The Pandemic Has Changed Consumer Preferences - It’s All About Health And Comfort Now

This post was originally published on Forbes.com.

After months of working from home many of us have adopted new habits. Some dived into home cooking, while others tuned into YouTube and Instagram workouts, and nearly everyone mastered the Zoom look – comfortable on the bottom, stylish on the top. In this new reality comfort, wellness and health are becoming a bigger priority for consumers and are driving their purchase decisions.

Consumers are becoming more cautious about their spending habits and are prioritising purchases in essential categories. While the fashion industry at large is going through tough times, not all the categories have been impacted the same way. According to McKinsey’s State of Fashion report, the industry overall is likely to contract by 27-30% in 2020 compared with the 2019 baseline figure. Meanwhile sportswear, activewear, and loungewear are emerging as the winners in this tough battle for survival.

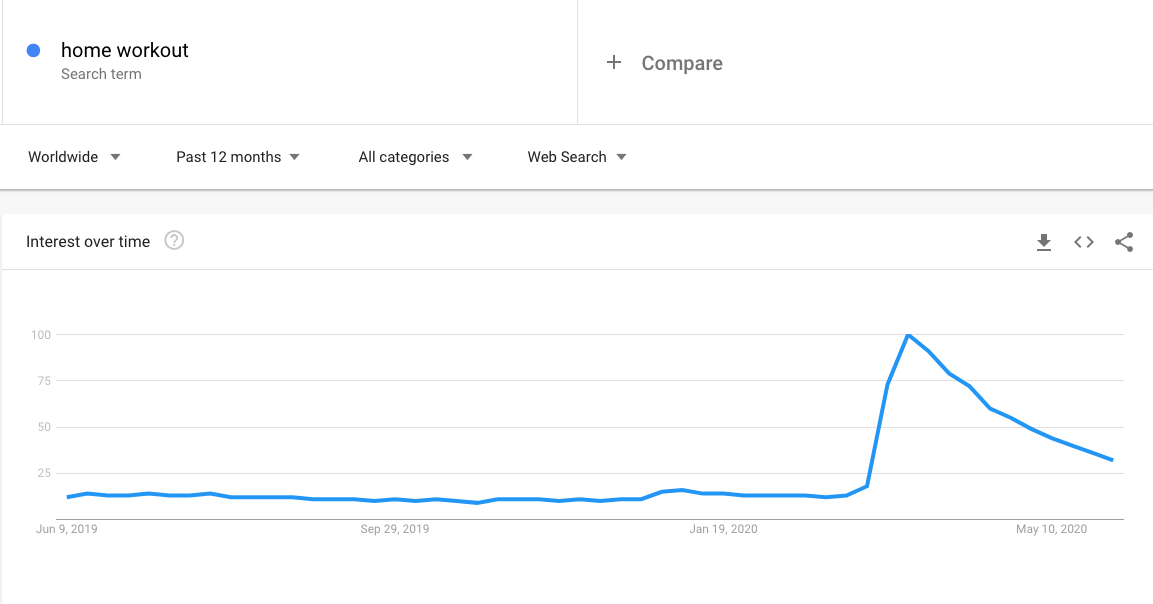

Sales of activewear in the US and the UK were up 40% and 97% respectively during the first week of April, according to retail analytics company Edited. This correlates with an increased interest in home workouts and online classes and a spike in Google searches in the first weeks of the global lockdowns. Despite more countries starting to lift shelter-in-places orders, the desire to stay fit has still remained higher than before COVID-19.

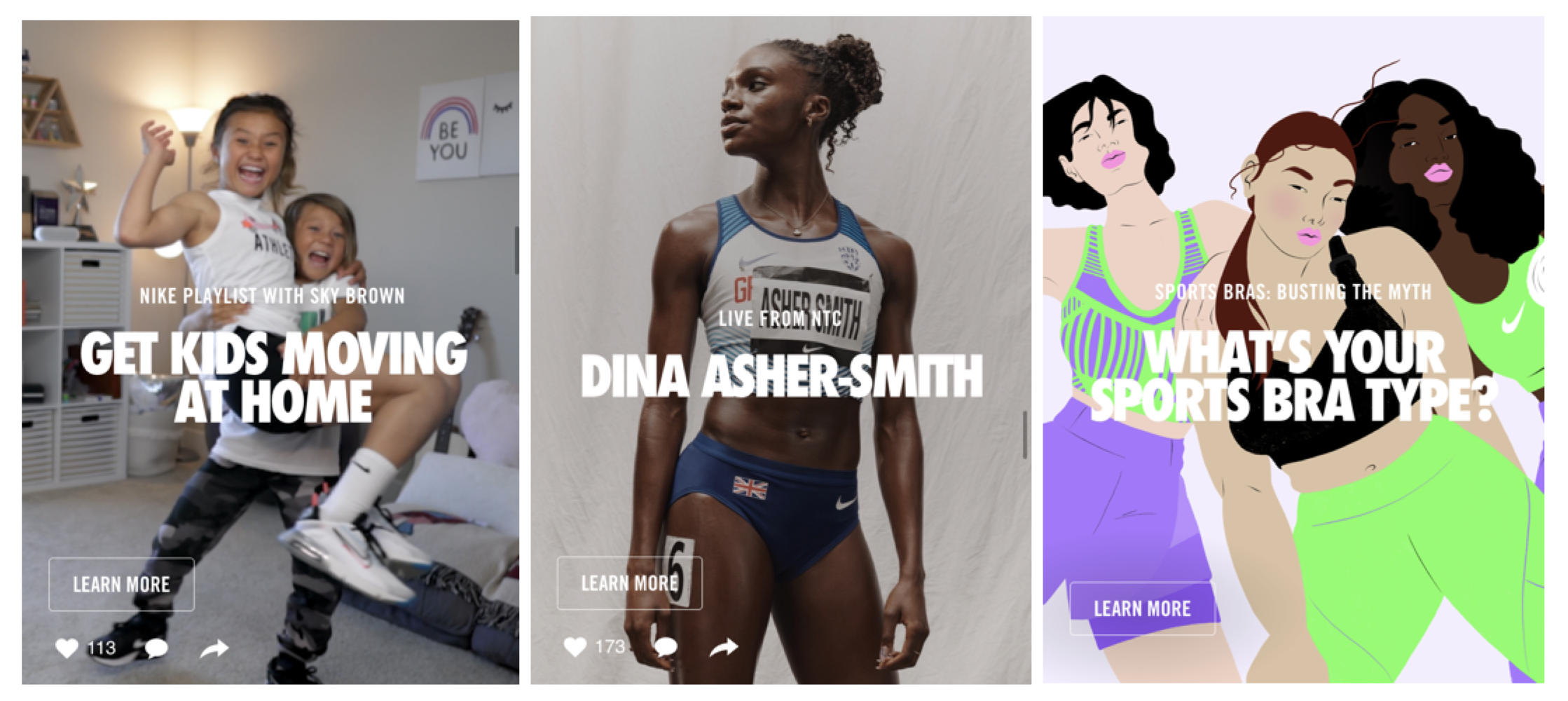

Many activewear brands, from Gymshark to Lululemon, are now publishing regular online workouts and live classes on Instagram. Nike has capitalised on the #HomeWorkout movement as well. Despite retail stores being closed, Nike’s revenues for the first quarter rose by 5% reaching $10.1 billion, with online sales up 36% compared to 2019. One of the most successful strategies was turning their Nike Training Club (a mobile app providing a range of online workouts) into a customer engagement channel and running special e-commerce promotions targeting regular users of the app. For example, the company dropped the subscription fees in China which led to a 30% increase in its digital sales in the country.

Nike has masterfully powered up its e-commerce channels with the increased consumer engagement. They ran a “Get kids moving at home” campaign and celebrity workouts with Dina Asher-Smith, the fastest British female athlete, while sharing tips on how to pick the right sports bra connected to their online store.

Workouts that can be done at home are not the only ones getting attention in recent months. An activity that has seen increased popularity is cycling. During the pandemic cycling was still permitted in many countries. In fact, in many places, it became the only appropriate and safe way of exercising outdoors without putting oneself or others at risk. According to the analytics company, NPD Group, in the US children’s bike sales increased by 56% and adult bike sales – by 121% compared to March 2019. Even in Europe, where cycling has traditionally been a popular activity, sales have soared. According to the Bicycle Association trade body in the UK, bike sales in the country increased by 50% in April, with seven out of ten buyers being new or returning cyclists.

La Machine, a cycling and sportswear brand, have experienced a similar surge in their sales as well. In my conversations with Rens Robroek, the co-founder of the brand, he mentioned that “with the cycling community getting bigger and bigger, we’ve seen a significant growth of first-time shoppers”. While the interest in cycling has soared, the brand didn’t just stand idly by. They have doubled down on the community-building element in their communication. Robroek told me that “keeping our customers well informed about what is possible and what is not and ensuring that we meet their expectations is the key”. He noticed that their customers, many of them being new to cycling, took extra time to research items before making purchases and the brand was there to provide any needed information and help with decision-making. The La Machine team also took this time to amplify their story of being a brand founded by dedicated cycling enthusiasts. They have been posting motivational pictures of cycling out in nature on their social media channels, to inspire those feeling cooped up in their homes.

With lockdowns easing up in some countries, many sportswear brands are facing a challenge – will they be able to keep the sales up when people are now able to return to “normal”? While the interest in home workouts might fade, working remotely seems to be a habit that will be harder to shake off.

Large companies, like Shopify, Twitter, and Facebook have announced that their employees will be able to continue working from home even after the lockdowns are lifted. With more companies shifting to remote work, the “Zoom looks” are also becoming a social phenomenon. One of them is a combination of comfortable bottoms that won’t be visible on a webcam, like yoga leggings or sweatpants, and stylish tops that people in the meeting get to see. According to Edited, sweatpants are now the fastest growing product category for active brands in the UK market, with leggings still being the most popular choice for female consumers. La Machine has leveraged this trend by expanding its offering from just sportswear to also include loungewear products like comfortable sweatpants and t-shirts. Customers might have come to their website during the pandemic in search of proper cycling wear but will have more options to choose from for an overall healthier lifestyle.

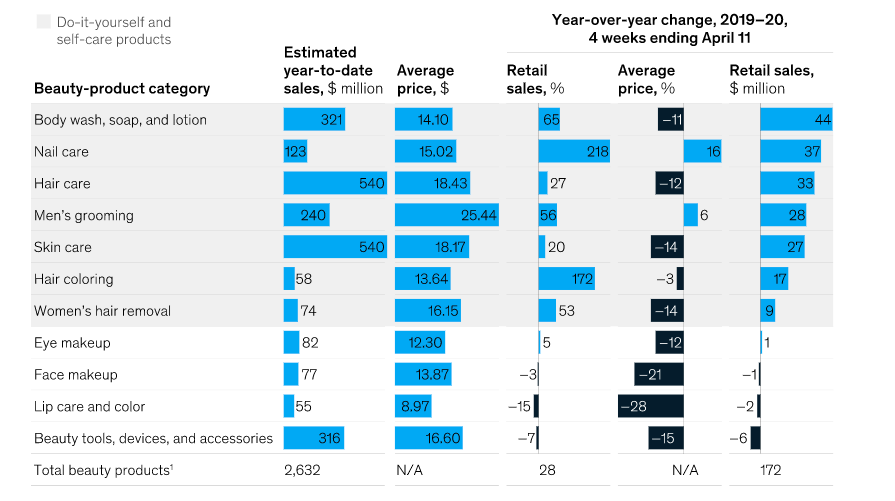

The desire to become and stay healthy has impacted the beauty industry as well. Overall the industry is expected to contract by 25-35%, according to McKinsey, and consumer preferences have also drastically shifted. Wearing masks and working from home reduced the need for buying more makeup and perfume. Consumers are now more interested in health and wellness. For example, the sales of a luxury hand soap in France were up 800% the week of March 16, 2020, when the country went into lockdown. Skin care is also among the growing categories with a 20% increase in sales.

Organic and clean beauty products that avoid the use of harsh and toxic ingredients have especially increased in popularity. According to Afterpay, the leader in the "buy now, pay later" space, the clean beauty category has grown more than 20% since March 2020. Consumers are not only keen on taking care of themselves, they are also considering the long-term effects on their health.

Wellness, comfort, and health now occupy a more prominent place in consumer considerations and habits. The COVID-19 pandemic has drastically changed our notions of staying healthy and safe. Wearing masks, obsessively washing our hands and using hand sanitiser has become the norm and many governments are still mandating these even after lifting shelter-in-place rules. In my recent piece, I talked about the changes that fashion and beauty retailers are adopting - like contactless payments, no try-ons of clothing and makeup, and other initiatives. We are also seeing an overall shift in consumer spending – away from spontaneous and “feel good” fashion and makeup towards products that make them feel healthier in the long run. Brands would do well to take note of this change and act accordingly.