How Black Friday Became Direct-To-Consumer Brands’ Day

With holiday sales well underway, this year direct-to-consumer brands are challenging Amazon’s e-commerce dominance. This Black Friday became the biggest one on the record for Shopify, an e-commerce platform for online stores, and its merchants with more than $900 million in total sales and over 9.3 million consumers making a purchase.

Why so many brands have had enough of Amazon

Amazon has fundamentally influenced and changed consumers’ shopping expectations with its fast deliveries, no-questions-asked returns and smooth shopping experience, making it nearly impossible for any other e-commerce business to compete. For a long time brands followed the: “If you can't beat them, join them” strategy while feeling helpless and unable to challenge Amazon’s influence. But this strategy came at a high price.

While Amazon gives sellers access to millions of shoppers worldwide and facilitates purchases, it also captures all the behavioural data–from what users search for, to what items they return and their reasons for doing so. This data is used in various ways and often against the brands that users initially came to Amazon to buy. For example, today Amazon offers nearly 158,000 private brand products from batteries to socks. During the recent House panel investigation of the four Big Tech firms, Amazon admitted to using “aggregated data” from sellers on its platform to inform decisions about its private label brands. To put it simply–Amazon uses the data that is created by customers buying products from sellers on its platform to create and improve their own private labels.

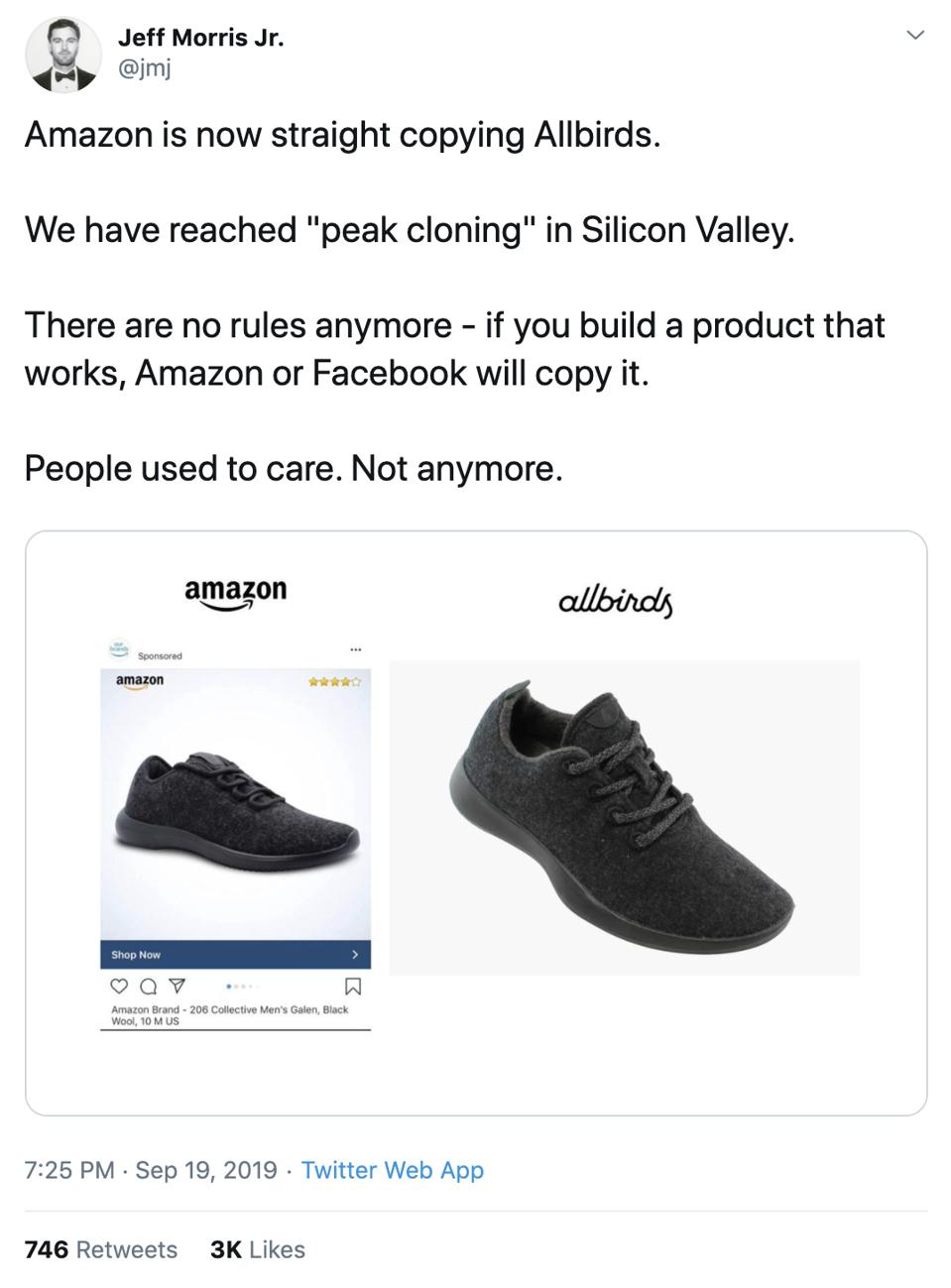

It’s no surprise that this data-driven approach often leads to Amazon offering copycat products that are similar to the original products but sold at a lower price. The latest victim of this phenomenon appears to be the fashion brand Allbirds and their famous sustainably-made wool sneakers which have never been sold on Amazon. What is currently for sale Amazon is a copycat version of Allbirds’ Wool Runners and their price is almost 50% lower than Allbirds’ originals.

With stories like these, brands are starting to look for other platforms and some are even going fully direct-to-consumer instead of playing along with Amazon's game.

Why the change is happening now

This recent shift to the direct-to-consumer model has become possible largely due to a growing ecosystem of tech enablers. These service providers cater to direct-to-consumer brands and small merchants and handle essential parts of their operations, like logistics, payments or entire e-commerce platforms. Essentially these tech enablers take the experience that shoppers come to expect from e-commerce in the current day and age and make it available to small merchants.

There’s Stripe to handle payments and Affirm, Klarna, Afterpay to enable shoppers to “buy now and pay later” or get small loans for expensive purchases. There’s also a range of companies tackling returns and improving the post-return experience, like ReBOUND, Return Logic and Returnly. And of course there’s Shopify, taking the hassle out of running a web-shop and providing a wide selection of add-ons and additional features that merchants can pick and choose from.

Going direct-to-consumer allows brands to build better and stronger relationships with their customers. These brands are able to gather and use both direct feedback and the valuable behavioural data to continuously improve their offerings and services. At the same time, they engage with the individual customer throughout the entire process–from discovery through shopping and delivery, to the post-purchase experience.

With the help of these affordable and easy-to-use tech services, direct-to-consumer brands are now able to make a run at Amazon without compromising on shoppers’ expectations, and we’re likely to see this trend continuing to grow in the coming years.

This post was originally published on Forbes.com.